Why Do the Biggest Companies Such As $AMZN and $GOOGL Keep Getting Bigger? It’s How They Spend on Tech!

My efforts to find great companies is primarily based on analyzing the fundamentals of each company. It is almost impossible for the average investor to directly understand the effectiveness of a company’s IT spending. Luckily, we don’t have to because that effectiveness should result in growing revenue and growing profitability (which we can directly monitor).

As you read the annual reports of companies though, an important consideration is the CEO’s comments about how IT investment is helping the company. If you fail to see this line of commentary, it should be a red flag for you. Conversely, a strong emphasis by the executives on IT spend that offers competitive advantage should at least be a signal to you to continue watching the company’s performance.

From the cited WSJ article (article may be behind a paywall):

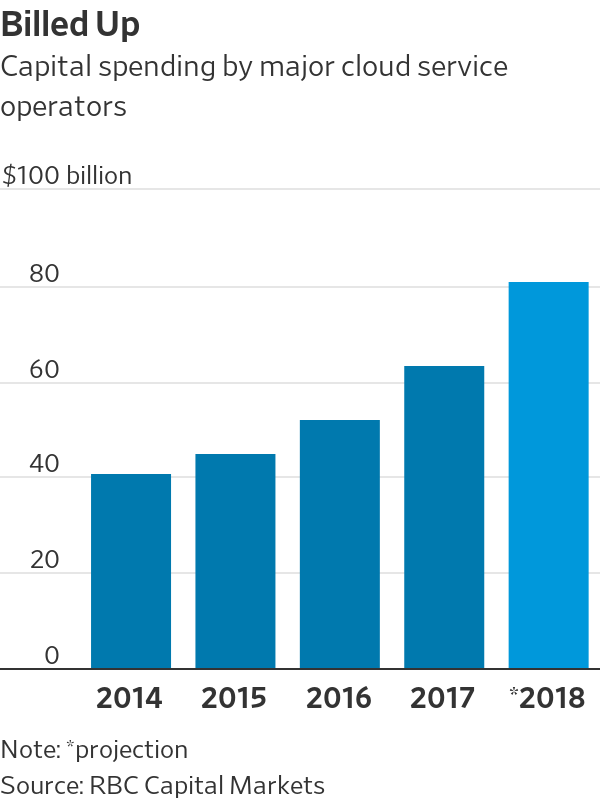

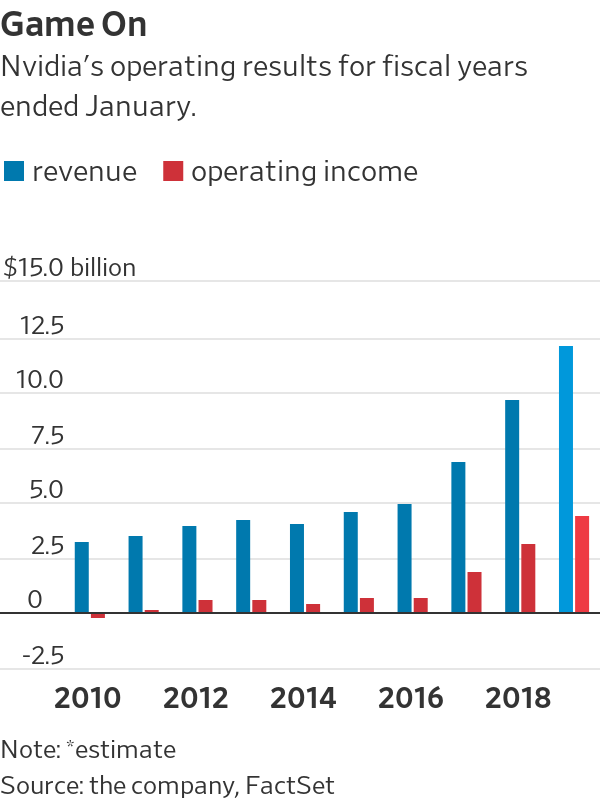

The secret of success for Amazon, Google and Microsoft is how much they invest in their own technology.

New data suggests that the secret of the success of the Amazons, Googles and Facebook s of the world—not to mention the Walmart s, CVSes and UPSes before them—is how much they invest in their own technology. IT spending that goes into hiring developers and creating software owned and used exclusively by a firm is the key competitive advantage. It’s different from our standard understanding of R&D in that this software is used solely by the company, and isn’t part of products developed for its customers.

Source: Why Do the Biggest Companies Keep Getting Bigger? It’s How They Spend on Tech