Investors are putting record amounts of money into exchange-traded funds as bonds become increasingly difficult to buy and sell.

Global fixed-income ETFs, which track bond indexes and trade like stocks, attracted $60 billion of inflows this year through May 25, according to data compiled by BlackRock Inc. That’s the most for the period since the funds were created 14 years ago and on pace to top last year’s record total of $93.5 billion.

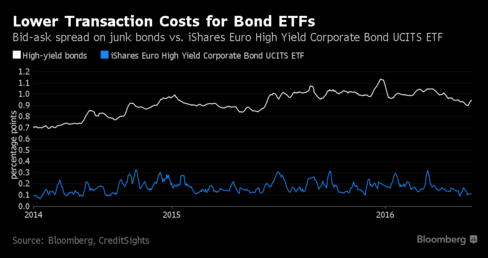

The funds are emerging as one of the few winners from worsening trading conditions as dealers pull back from making markets and investors seek cheaper ways to take and hedge credit exposure. Liquidity and ease of use are the top reasons given by about 70 percent of bond ETF users, according to a report by Greenwich Associates.

Fixed-income ETFs manage about $576 billion of global assets, ranging from Treasuries to high-yield corporate bonds and emerging-market debt. BlackRock, the biggest provider of the funds, started Europe’s first ETF for mortgage-backed securities last month.

Source: Wall Street Turns to ETFs to Sidestep Illiquidity in Bond Market – Bloomberg